Research articles

Published in December 2025, Boston Consulting Group’s recent paper on AI agents is trading at a premium. Check out the highlights.

What lessons can be learned from the humble shampoo bottle? Design inspiration. Thanks to Paul Brown’s invention in 1991, shampoo bottles could be designed “upside down” to dispense at the bottom, thereby eliminating the need to frantically shake-weight the darn thing into submission. Heinz, Gerber, NASA all adopted his design. For the many software engineers and designers soaked in usage data, nothing beats a refreshing real-world insight. Soak it up!

What can the tractor teach us about AI adoption? The global workforce of 3.5 billion people will have to evolve, especially these 5 most at-risk jobs for AI elimination. What can employers and employees do to accelerate change? Top ten recommended learning resources + the most in-demand job skills of 2024.

Expanding upon Ben Horowitz’s viral article, Peacetime CEO/Wartime CEO, to highlight how top Go-To-Market leaders operate/lead differently in wartime.

Exploring how randomness manifests across disciplines, along with ways to harness it for greater knowledge, creativity, and productivity.

Exploring a few powerful ChatGPT use cases to help Customer Success professionals be more productive, e.g. Advanced Data Analysis, Plugins/Extensions.

Responding to America’s most popular song with data and resources in hopes to 1) add some objectivity to this ongoing cultural dialogue, and 2) offer potential solutions.

Dutch billionaire Frank Slootman is one of the most successful CEOs in history. One of my favorite podcasts, The Knowledge Project, recently interviewed Frank. He believes in “extreme meritocracy” and likens companies to professional sports teams. Frank could be described as ruthless, direct, and decisive with a “natural malcontent posture.” But there’s one thing he loves above all: winning.

Renowned pianist André Watts passed away July 12, 2023—his obituary can be found in The Economist. In many ways, Watts’ life celebrates triumph over adversity via mastery of his craft. “Be so good they can’t ignore you,” as Steve Martin suggests, certainly applies to André Watts. His life and work offer valuable lessons in achieving mastery—and worldwide fame—despite numerous obstacles.

Successful venture capital firm Craft Ventures was founded in 2017. Interestingly, 65% of the (massively) successful exits on their website occurred before the firm even existed. Let’s talk about how to most effectively—and of course ethically—craft a VC track record.

Is Customer Success just a bandaid for bad software? Answer: Sometimes. Customer Success can be an expensive solution to endemic product problems. It can also be an incredibly lucrative function (and career), but make no mistake: it can be built badly. To build Customer Success right, a sober appraisal of your company, your software, and your customers is critical. Otherwise, you risk throwing (expensive) bodies at the problem.

Exploring the psychology of “busy” to decrease distraction and get 2-3 hours back per day.

What can the iconic disco ball teach us about diversity? Get down and boogie with a style of leadership that respects myriad people and perspectives. May the best team win!

In an era polluted by fake news, rhetoric and divisive judgement, it has become increasingly hard to maintain productive, rational discourse. 60% of adults get their news from social media. The majority of content we consume each day is selected by algorithms designed to capitalize on our brains’ cravings for novelty by way of hijacking—in polarizing fashion—our emotional response. As a result, rational discourse is becoming a lost art. In the very least, we can save time by figuring out who we’re dealing with—be it a spouse, coworker, friend or Twitterati— by asking: What would make you change your mind?

The only positive-sum, apolitical way out of the current US government-fueled, inflationary, debt-laden debacle is to increase productivity. The other ways are increasing taxes and reducing government spending. However, “productivity” is a government statistic that is: laggy, often misunderstood, very complex, and archaic. Nascent AI applications, e.g. chatGPT, autoGPT et al, hold tremendous potential, but their connection to the US productivity is opaque at best.

DBT-backed coffee startup kills it on Shark Tank. Mark Cuban says CEO’s coffee business is a ‘brilliant idea’ on Shark Tank: ‘You’re worth more’ than $7 million. Founder Maggy Nyamumbo delivers one of the best pitches in Shark Tank history.

The business case for offering employees paid family leave is strong. For founders offering their employees 12 weeks family leave, we estimate the ROI at 160% based on reduced attrition alone. Confidence in assertions is modest due to publicly-available data quality.

The VC-fueled startup bubble will pop in the next 6-12 months. Once the froth has been purged, expect Series A-E round valuations to come down 30-50%. The 2021-2022 VC vintage may go down as the worst-performing in the history of venture capital.

Unpopular opinion: Slack reduces employee productivity due to incessant distraction and its assault on ‘Deep Work.’

Interested in doing an Ironman or getting your pilot license? Here is an overview of the 1) financial cost, 2) time required, 3) reward, and 4) my (many) mistakes/learnings along the way.

Top takeaways from Jim Rohn’s short-yet-insightful book, The Seasons of Life. “Life and business are like the changing seasons. You cannot change the seasons, but you can change yourself. Therein lies the opportunity to live an extraordinary life, the opportunity to change yourself.”

The #1 mistake we’ve seen startups make is they try to solve software problems with people, and people problems with software. Are startups hiring too fast and buying too much software? Our contention: Yes.

Tip of the cap to Affinity cofounders Ray & Shubby for raising $80 million dollars to accelerate their growth.

As one of the smartest and most successful humans alive, Charlie Munger employs mental models to improve his decision making. This article focuses on his 25 psychological tendencies, along with ways to put them into practice.

Top takeaways from an episode of Mike Maples’ (excellent) podcast Starting Greatness about the 3 types of waves founders can catch: 1) Technology, 2) Adoption, and 3) Regulatory.

What habits do you have today? Morning coffee, checking email, exercise, thumbing through Instagram, watching TV? Habits have a profound compounding effect, so its critical to pause and reflect on our habits—are they helping or hurting us?

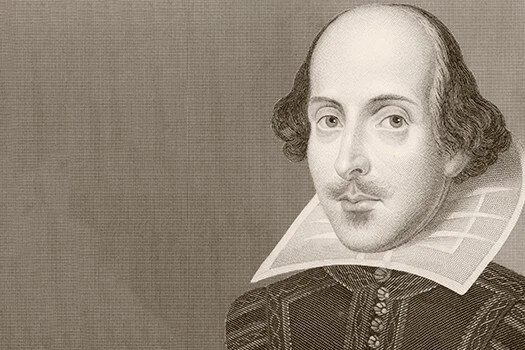

With help from Shakespeare, we explore how intellectual honesty yields better decision-making, and the teams that make the best decisions win. Therefore, leaders would be well-served to define what “intellectual honesty” means in practice, and treat it as an operating principle or cultural value.

Insights and inspiration from Affirm’s 2020 Diversity, Equity & Inclusion (DEI) report, along with our hearty support of the high bar they set for other companies.

For example, Affirm achieved a 12.5% YoY increase in female representation in Engineering & Product— a massive accomplishment!

Analysis, insights and a “Prep & Screen” tool for evaluating “advisors” in their many shapes and forms.

According to writing master Bill Zinsser, author of On Writing Well, good writing is about humanity and warmth, expressed with clarity and strength. Business writing is often the opposite of this. Try these 4 tips for more effective business writing.

Leaders who are skilled storytellers have an unfair advantage. They can out-sell, out-motivate, and out-lead other executives less-versed in the art of story. This isn’t about extroverts vs. introverts—rather, a skill anybody can learn. Peter Guber is a good person to learn from. With his 50+ Academy Award nominations and best-selling books, Guber is considered a master storyteller. Let’s see what he has to say.

Perhaps the most overused word in tech startups, the word ‘scaling’ has shouldered many meanings. Let’s take a look at them, and get clear about the various types and ways of scaling a business. Why is this important? Because clarity drives team alignment and improves the odds of successful execution.

The average American spends 11 hours per day staring at screens. As smartphones, streaming and social media inundate our dopamine-addicted brains with content, our collective consciousness is being commoditized. This is generally bad, but a reality we must confront. This article explores the data behind Instagram usage, Netflex et al, along with a few ways we can regain our focus and, eventually, our consciousness. Thumbs crossed.

A retrospective on the results from 4 years of quarterly goal setting. The purpose? Identify ways to improve my goal-setting process so that I can accomplish more and live a fulfilling life.

Inspiration and learnings from an epic zip-lining adventure across redwood trees in Guerneville, CA! Coastal redwood trees are the tallest trees in the world (350-400 feet), but they don’t have the traditional deep tap root to anchor them.

How do redwoods grow to be the tallest trees in the world without deep roots? Amazingly, redwoods connect their roots with each other underground to form a vast web-like network.

![Ready. . . Aim. . . [check smartphone]](https://images.squarespace-cdn.com/content/v1/55dbfccee4b08731143170b6/1527214735848-JXL81VT0W8FJJ03L6M5J/smart+phone.jpg)