“While we try to teach our children all about life, Our children teach us what life is all about.” –Angela Schwindt

TL;DR - the business case for offering employees paid family leave is strong. For founders offering their employees 12 weeks family leave, we estimate the ROI at 160% based on reduced attrition alone.

My partner and I were recently blessed with our second child, a healthy baby boy. We quickly began adapting to raising two children vs. one.

“Our best advice is to sink into your primordial self,” said one of the doctors.

“Set aside any Type-A tendencies, and don’t try to do too much,” said another.

Doctors orders.

So began our adventure as a family of four.

Thank you, employers

My partner and I are incredibly fortunate to work for companies that offer 12-16+ weeks of paid family leave. We are both (currently) on family leave, and deeply enjoying the bonding time and little developmental milestones we may have otherwise missed. We are so grateful to our employers (LinkedIn & Afresh) for this once-in-a-lifetime experience. It would be tone-deaf if we didn’t acknowledge that not all companies offer such generous benefits.

In fact, the U.S. is the only advanced country in the world that does not mandate paid maternity or paternity leave, and only 12% of Americans have access to paid parental leave.

The business case for family leave

Being on the receiving end of this lavish benefit got me thinking:

Does offering family leave actually make business sense for founders/employers?

Are they just offering it—potentially at a loss—to stay competitive with other tech employers?

Is there a point beyond which family leave brings diminishing returns, e.g. Finland offers 1 year, and Netflix does too!

Lots of questions. Let’s dig in.

Does offering paid family leave actually make business sense for the employer?

Losing employees is expensive: estimated at 150% of the former employee’s salary. So if an employee makes $150k OTE, the cost of replacing them is ~$225k.

In 2015, Accenture doubled its maternity leave from 8 to 16 weeks. Since then they’ve seen a nearly 40% reduction in the number of moms leaving their jobs after the birth or adoption of a child.

When Google expanded its parental leave policy from 12 to 18 weeks in 2007, the retention rate of women post-maternity leave increased by 50%.

When Aetna expanded its maternity leave policy, the percentage of women returning to work there jumped from 77% to 91%—and 18% increase.

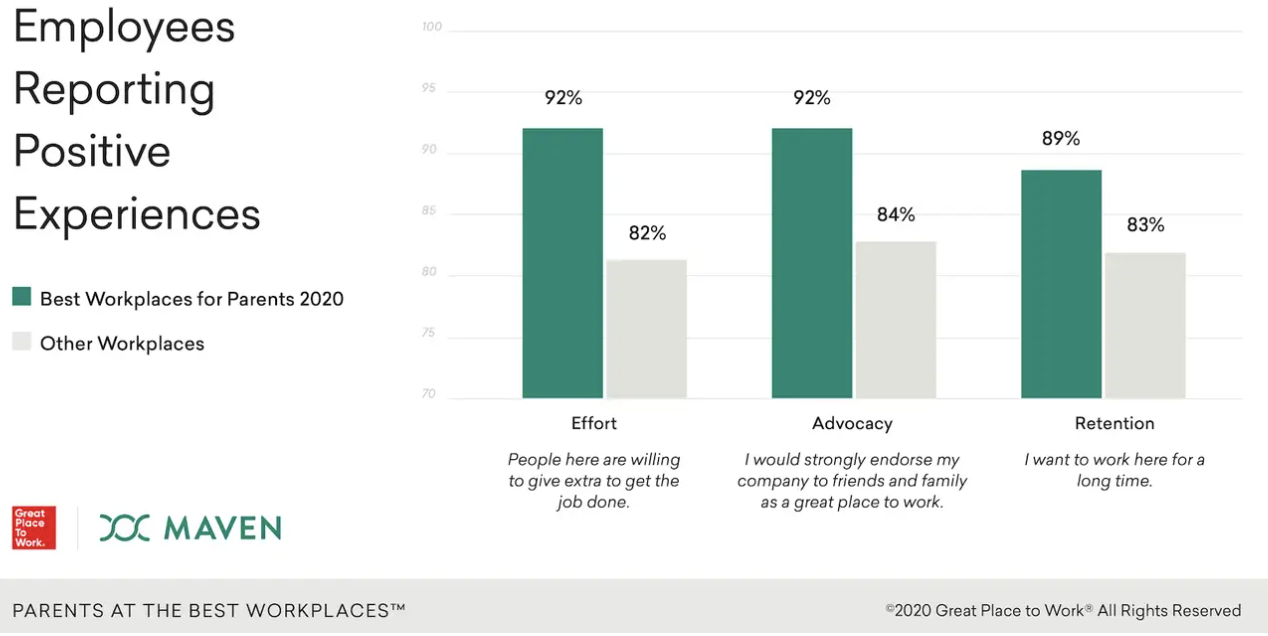

A 2016 EY study of more than 1,500 employers found that offering paid family leave correlated with an 80% increase in employee morale, and 70% increase in productivity.

Based on numerous research studies, the benefits of offering paid family leave is substantial. But what about the cost?

The cost of offering paid family leave

The cost of offering family leave nationally, is estimated to range from 0.45% to 0.63% of nationwide payrolls.

In some states—11 of them to be precise*—the cost of paid family leave is partially covered by the state.

Example: if you live in California, PFL would cover 60-70% of wages you earned 5 to 18 months before your claim start date. This program is funded entirely by workers—not employers—via a State Disability Insurance payroll deduction (about $30 per year on average). Therefore, it’s cheaper for companies to offer PFL in these states, ceteris paribus.

But there’s a limit to state generosity: California PFL, for example, lasts 8 weeks with a max weekly payout of $1,540. This means that the total state payout will never exceed $12,320.

For a worker making $150k: if the employer decides to offer 12 weeks paid leave, this equates to $34,615 ($150k/52 * 12). The state will chip in $12,320, so the employer is on the hook for the remaining $22,295.

Rough rule of thumb: for an employer offering 12 weeks of paid family leave to a $150k worker, the cost is between $25k-35k (depending on the state they employee works from; not including admin costs).

* California, Washington, Oregon, Colorado, Connecticut, Delaware, Massachusetts, Maryland, New Jersey, New York, Rhode Island.

ROI on paid family leave

Let’s focus on the most costly problem that paid family leave can address: attrition.

We’ve established that the cost of replacing a $150k worker is about $225k.

We’ve established that offering paid family leave to a $150k worker requires an employer to invest $25k-35k+.

Offering PFL has been shown to increase post-maternity retention by 18-50%, generally bringing it from ~65% up to ~90%.

Using a sample size of 100 workers going on family leave, the employers’ total investment would be $3.5m (using the $35k higher-end of the range, ceteris paribus).

Without family leave, we’d expect 35 workers to quit costing $7.88m is replacement costs.

With family leave, we’d expect 10 workers to quit costing $2.25m in replacement costs.

Using simple math, the family leave benefit delivers a replacement cost reduction of $5.63m.

Return on Investment (ROI) = 160% ($5.63m / $3.5m)

Operational Pressure Test

Persistence and resilience are hallmark traits of winning companies.

When a teammate goes on family leave—whether as an IC or manager/leader—it puts operational strain on the team. This strain is healthy because it forces increased responsibility and decentralized decision-making.

According to Cecilia Xia at Change.org, “What we’ve seen is that when someone leaves for parental leave, it gives other members of the team the chance to step up and prove themselves at a higher level. Often, this has resulted in official promotions, benefiting the individual and the company as a whole.”

Do the children benefit?

Ironically, one of the most under-studied elements of paid family leave is the impact on the children for which family leave is being taken. Thankfully, the veil is beginning to be pulled back, and a few studies have shown:

Increased regularity of well-baby check-ups

Greater rates of immunization

Increased likelihood and duration of breastfeeding

Increased parental care and engagement

Assumptions / Counterfactuals

For simplicity, we assumed an employee salary of $150k/year and a 12-week paid family leave benefit (fairly common in the software industry).

This article assumes you want to retain your employees, and does not distinguish between regrettable and non-regrettable attrition.

Ex./ As a founder, if you needed to decrease your burn rate in the example above, the HC costs of the incrementally-retained 25 employees ($3.75m/year or $312k/month) might actually be worrisome.

The data on paternity leave for fathers is sparse, so any extrapolations or conclusions should be made with considerable skepticism.

Higher-salary employees are, by definition, more expensive—but also more costly to replace. Interestingly, the employer ROI actually increases for higher-salary employees.

In the example provided above, if we assume OTE of $250k/year (instead of $150k/year), the ROI increases from 160% to 207%.

The costs of staffing & administering a family leave program have been excluded due to high-variability and questionable data quality.

I was asked to return to work from paternity leave 5-10 day early in Jan-2023 to contribute to Afresh’s Annual Planning process, so technically I haven’t experienced the full benefit. This depends on the nature of your employer, but I would encourage others to NOT take paternity leave during annual planning, if at all possible, to avoid this unfortunate conflict.

The additional advantages of offering family leave—e.g. increased employee morale & engagement, increased productivity, etc.—have been excluded from this ROI calculation.