Rich men north of Richmond

A few weeks ago my brother texted me a video of his 3-year-old son dancing to a folk music video. I replied:

“Who’s the artist? He’s ripping it. Unique guitar too.”

“Oliver Anthony.”

“Will check him out.”

Little did I know Oliver Anthony’s Rich Men North of Richmond would soon be the #1 song in the country.

If you haven’t yet seen/heard this 3:10min phenomenon, I encourage you to witness this impassioned, homemade Appalachian folk song.

The media, unsurprisingly, has been obsessed with this unknown artist’s provocative critique of America—and quick to paint it political.

Rather than politicize this simple-yet-powerful song, I’m going to do something different: respond to each of Oliver Anthony’s concerns with data and resources.

In this way, I hope to 1) add some objectivity to this ongoing cultural dialogue, and 2) offer potential solutions. After all, pulling ourselves up by the bootstraps is the American way, isn’t it?

Oliver Anthony’s main concerns

Having listened to the song ~30 times, below are what seem to be Oliver Anthony’s main concerns in descending magnitude (based on lyrical emphasis, not the severity each issue):

Wage stagnation of the working class: wages not keeping up with economic productivity.

“I’ve been sellin' my soul, workin' all day, overtime hours for bull$hit pay.”

Inflation & taxation: our American-dollar earnings not buying as much as they used to.

“Cause your dollar ain't $hit and it's taxed to no end.”

Rich men seeking control: condescending elites leading the country astray.

“Lord knows they all just wanna have total control. Wanna know what you think, wanna know what you do. . .”

Welfare abuse: taking advantage of government programs.

“Obese milkin’ welfare” buying “bags of fudge rounds.”

Homelessness: more citizens living on the streets in poverty.

“Folks on the street ain’t got nothing to eat.”

Suicide: young citizens “puttin’ themselves six feet in the ground” because:

“All this damn country does is keep kickin’ them down.”

Heavy stuff. These are important issues. Let’s dig in.

1. Wage stagnation of the working class

Over the last 25 years average American wages from increased 115% from $13 to $28/hr. This data is from production employees in mining, logging, manufacturing, construction and nonsupervisory employees in service industries. These groups represent 80% of the total non-farm employment.

Here is the average American wage in dolars-per-hour over time:

Over the same period, US Gross Domestic Product (GDP) grew 181% from $9 to $25.5 trillion.

To summarize: over the last 25 years, American wages have increased 115% while the economy has grown 181%. So from this vantage point, Oliver Anthony’s concern seems valid: wage growth hasn’t kept up with economic growth. Furthermore, not all American states/regions pay the same, so the South has reason to feel a bit disillusioned.

If wages had kept pace with economic growth, the average America wage today would be $36.53/hr vs. $28/hr—a difference of $8.53/hr.

Given the typical American worker clocks in about 2,000 hours of work per year, this $8.53/hr gap equates to $17,060 is lost annual income (or $1,422/month). Significant. More on this in the What can we do? section.

2. Inflation and taxation

This is a tricky one due to 1) the nature of inflation, and 2) America’s tax system—the most complex in the world. These are really two distinct issues, but I’ve combined them for brevity and to respect Oliver Anthony’s songwriting. Let’s start with inflation:

Inflation peaked at 9.1% in June 2022. Since then, it has come down to 3.2% in July 2023. But that doesn’t mean the historic rise in inflation—from 0% during the pandemic to 9.1% in June 2022—wasn’t extremely painful, especially for those on fixed income.

So when Oliver Anthony sings “Your dollar ain’t $hit,” he certainly had a point a year ago. But thankfully inflation has returned to more normal levels—at least for now.

Tax rates over the last 25 years have been about the same:

Lowest tax bracket: pays 10-15% taxes

Highest tax bracket: pays 35-40% taxes

I’m not a tax expert, but it would appear Oliver Anthony’s claim of being “taxed to no end” is unjustified based on historic federal tax rates.

Virginia's state income tax has been 5.75% for the last 15+ years—a rate which is moderate (27th lowest tax rate out of 50 states).

Contrary to headline journalism and “fair share” rhetoric in America, the wealthy pay significantly higher taxes—both tax rates and total tax dollars—than less fortunate citizens.

Let me put it more bluntly: The top 50% of all taxpayers paid 97.7% of all federal individual income taxes, while the bottom 50% paid 2.3%.

3. Rich men seeking control

Perhaps the most ambiguous song reference, these “rich men north of Richmond” of the song’s title aren’t doing us any favors, according to Anthony.

The conflict between the have’s and have not’s is as old as time. True to human nature, every generation tends to lament the elites who have more than they do.

Or as Warren Buffett says more eloquently, “It is not greed that drives the world but envy.”

But Oliver Anthony also mentions a desire to “know what you think, know what you do”—so perhaps his concern is actually technology companies (Alphabet/Google, Meta/Facebook/Instagram, Amazon, Netflix et al) infiltrating our daily lives in a data-for-convenience trade?

Hard to tell without talking to the artist.

If the rich men’s desire for “total control” is actually a data privacy issue, then there are many things each of us can do to increase privacy. These are covered in the What can we do? section.

4. Welfare abuse

In fiscal year 2022, the federal government spent $1.19 trillion on more than 80 different welfare programs. That represents almost 20% of total federal spending and a quarter of tax revenues in 2022 or $9,000 spent per American household (source).

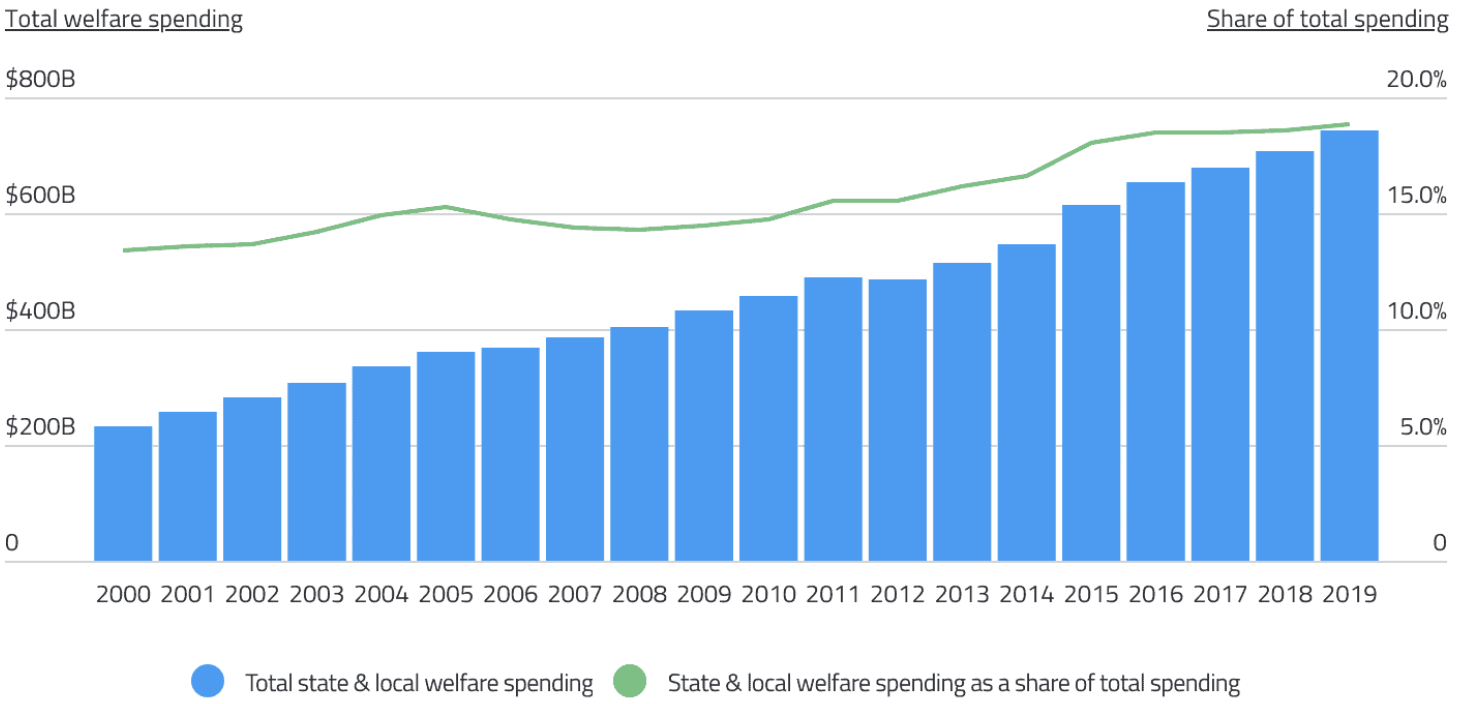

Over the last 25 years, welfare spending has increased 400-500% (which spiked in 2020-2021 due to pandemic relief programs and Biden’s subsequent spending proposals).

Source: US Census Bureau

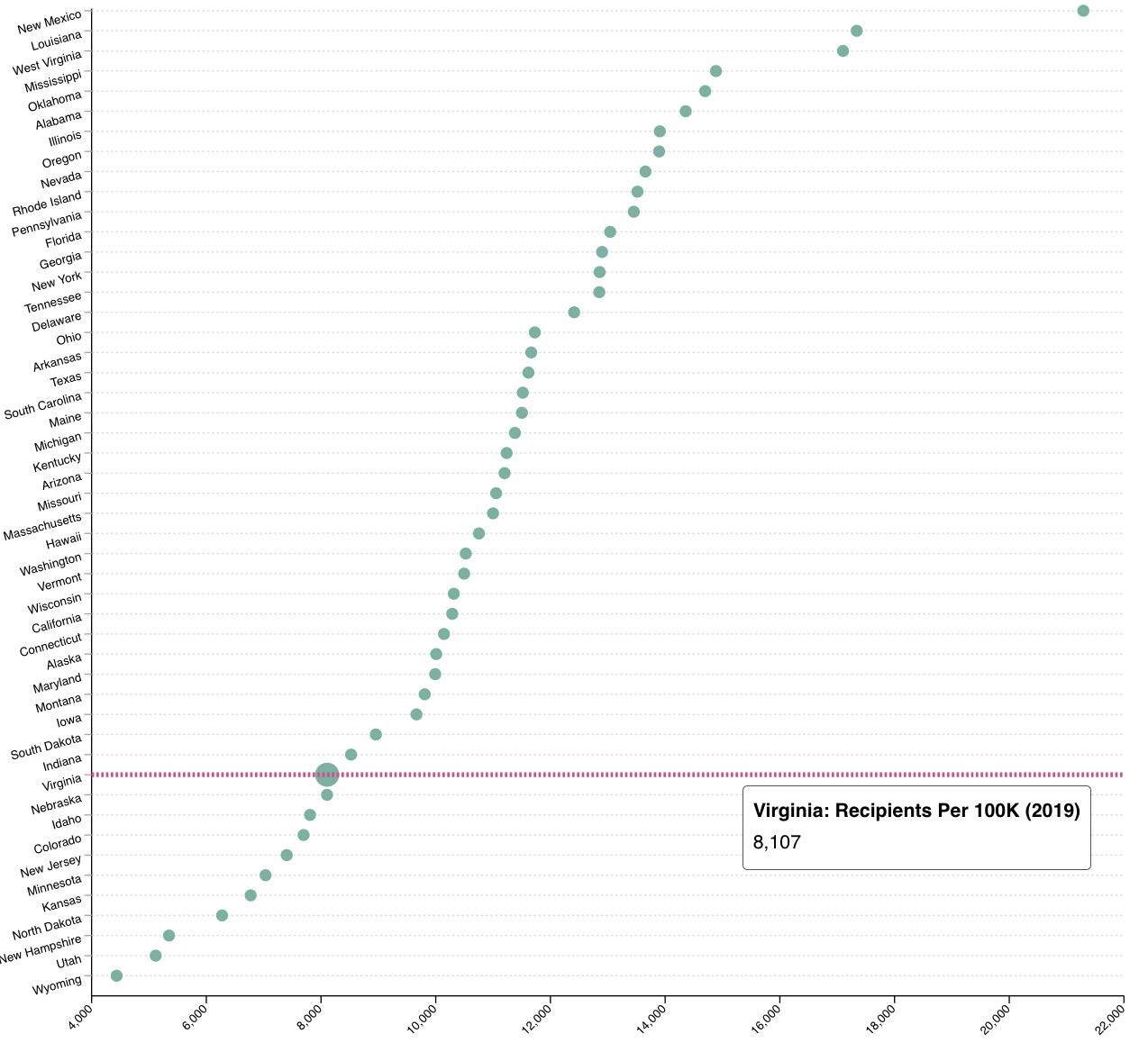

But Anthony, it seems, takes issue with one particular welfare program: SNAP food stamps. Interesting, Anthony’s home state of Virginia has the 11th lowest # of SNAP recipients per 100,000 people, i.e. 8,107 SNAP recipients per 100,000 Virginians.

Welfare, when done properly, is society’s safety net. When done wrong, it breeds abuse and dependency. But there is no doubt people abuse government welfare:

“Improper welfare payments, including welfare fraud and welfare abuse, are estimated to be 13.3% of all federal welfare payments. They total $162 billion in the fiscal year 2022.”

SNAP is the 4th-most-abused program with an estimated fraud rate of 7.4%. But the majority of welfare abuse (87%) is actually fraud in Medicaid and tax credits.

So it would appear that Anthony’s concerns about welfare abuse are valid (abuse exists), but perhaps misguided by singling out obese people using SNAP to buy dessert.

5. Homelessness

I was born in San Francisco and raised in the Bay Area where homelessness is rampant. California has the highest homeless population in the country both in terms of: 1) total people: 172,000, and 2) per capita: 44 homeless per 10,000 people (source)—about 6x more than Virginia.

Virginia has 6,500 total homeless, or about 7.6 homeless per 10,000 people.

Setting aside state-specific nuance, homeless is undoubtedly an American tragedy. Thankfully there are some efforts underway to address homelessness in America, discussed in the What can we do? section below.

6. Suicide

Looking at the below chart of US suicides by 100,000 people, the top 3 at-risk age groups are:

85+ years old: 22.39%

75 to 84 years old: 19.56%

25 to 34 years old: 19.48%

So it would appear Oliver Anthony has a point in that young men are certainly a high-risk age group for suicide.

Source: AFSP

And looking at the overall trend: over the last 22 years, the US suicide rate has increased 40% from 10.4 suicides per 100,000 in 2000 to 14.6 in 2022 (provisional).

The below chart is missing 2021-2022 data, but I was able to find the above-referenced datapoints elsewhere on the CDC website.

Source: CDC

So one must agree, in principle, with Oliver Anthony’s sorrowful lyric: “Young men are puttin’ themselves six feet in the ground”—but not necessarily his reason for why they committed suicide: 'Cause all this damn country does is keep on kickin' them down.”

What can we do?

You cannot control what happens to you, but you can control your attitude toward what happens to you, and in that, you will be mastering change rather than allowing it to master you. —Brian Tracy

Some things are in your control. Others aren’t. In the American tradition of resourcefulness and self-reliance (vs. complaining), let’s consider what we can actually do to confront these very real issues.

1. Wage stagnation of the working class

As the legendary Jim Rohn says in his masterful The Art of Exceptional Living, “Learn to work harder on yourself than you do on the job.”

Simple advice, but far from easy. After a hard day’s work, most Americans—especially if they have kids—would rather eat something, watch TV, and get some rest. Understandable. But this is the exact time they should be investing and planning for the future.

To earn more money and increase your value to the marketplace, we must learn new skills.*

How? Pick a skill, then learn it. Thanks to the internet, we no longer have excuses to not learn new skills: Linkedin Learning, Khan Academy, Teachable, Udemy, Indeed, Online Skill Center, Explore the Trades, Skillwork, and of course, YouTube. And of particular note for technicians: TAP (Train All People).

Rather than passively hope for wages to increase, the best strategy is become more valuable by learning new skills.

2. Inflation & taxation

Tony Robbins said it best: “Anticipation is the ultimate power.”

Inflation and taxes are largely out of your control, but they can be planned for.

Taking advantage of Roth IRAs and Roth 401ks (post-tax dollars that grow tax-free) and Traditional IRAs and 401ks (pre-tax dollars that get taxed later) are simple examples.

Equity—owning part of a business—is how most Americans get rich. Working for an hourly wage is a very hard way to build wealth, unless you’re able to save 20-30% of your income—and have your savings successfully compound in the stock market for 30+ years.

Rather than complain about inflation and taxation, the best strategy is to earn equity in a business (and become more valuable via new skills).

3. Rich men seeking control

On social media: “If you don’t know what the product is, you are the product.”

Assuming Oliver Anthony is referring to a lack of privacy, there are many ways to reduce your digital footprint:

Delete your digital profiles: Google, YouTube, Facebook, Instagram, TikTok, WhatsApp.

Delete most of the mobile apps on your phone, i.e. delete Instagram et al.

Unroll.me will help clean up your email inbox from all the spammers.

Adding your name to the Do Not Call List legally requires companies to prevent their telemarketers from calling you. If they do, they can be severely fined.

Turn off location tracking on your Android or iPhone settings.

When possible, pay for things with cash. Credit card companies and credit agencies have immense data warehouses on consumer behavior.

If you use Amazon, rethink your relationship with the company. Do you really need all the stuff you buy from them? Could you find it elsewhere?

Stop watching Netflix: if you don’t want people to know what you do, then you’re better off resorting to old-school VHS, DVD, Blueray which won’t create a digital trail of your content consumption.

Browse the internet incognito.

4. Welfare abuse

Largely out of your control. Again, the largest welfare abuse is not obese people buying fudge rounds, but in Medicaid and tax credits.

N.B. In the olden days, poor people used to be thin. Less money = less food. Mass food processing and production changed this dynamic. Now you can buy cheap food, i.e. fast food, for less money. Obesity-related chronic illness drives 70% of our healthcare costs. But since Anthony doesn’t take issue with obesity explicitly, let’s move on.

Vote for a representative** that wants to tackle welfare abuse.

5. Homelessness

The leading solutions tend to be: housing development, shelters/alternative housing, and drug/mental health programs.

Vote for a representative** that wants to tackle homelessness.

6. Suicide

Check in with a friend who’s recently lost a job. This is a big driver of suicide due to perceived lack of purpose.

Check in with a friend who’s recently gone through a breakup. This is another massive contributor to suicide due to emotional instability.

Talk to—or recommend someone you know talks to—a therapist: there are some cost-effective options online like BetterHelp, Regain and Talkspace to help individuals improve their mental health. $50-80 per session. For whatever reason, most people just don’t do it.

Appendix

* If you don’t make a lot of money—see green/orange lines below—the fastest way to level-up to the red/grey/blue/black lines is to become more valuable to the marketplace by learning new skills.

** On voting: the poorest 50% of America is comprised of about 156 million people. Thanks to the democratic process, Americans can—sometimes rapidly, but often slowly—change things by the power of their vote. Sadly, the most people who have ever turned out for a major election is 81 million.