Summary

Is Customer Success just a band-aid for bad software? Sometimes.

Customer Success can be an incredibly profitable function, but it can also be a misguided investment.

To build Customer Success right, a sober appraisal of your company, your software, and your customers is critical. Otherwise, you risk throwing (expensive) bodies at the problem.

Is Customer Success just a band-aid for bad software?

Customer Success (CS) is a non-trivial investment. As a warm up exercise, consider this (actual) pre-board meeting dialogue:

CEO to CFO: “How much are we spending on Customer Success?”

CFO: “A lot. $12.5 million per year, or about 25% of revenue.”

CEO: “What are getting from our annual $12.5 million investment in Customer Success?”

Answer: [Fill in how YOU would respond to your CEO. Is it churn prevention? Successful renewals? Health scores? Client references? High close rate expansion opportunities?]

Today’s startup ecosystem is frightened. Every dollar of spend is being scrutinized. Visceral cost pressure and new technologies will continue to evolve Customer Success efficiency, e.g. chatGPT, automation. But in the meantime, the fact remains: 90% of Customer Success cost is still human headcount.

Size of Customer Success teams

Most teams are pretty small: 56% of CS teams are sub 20.

Source: Churn Zero CS Leadership survey 2022 (n=1,037)

And if we drill down into the green column above—just the teams with 1-19 headcount—the largest bucket by a modest margin is: teams with 5-9 people (dark green; 36%).

Source: Churn Zero CS Leadership survey 2022 (n=581)

Based on what I’ve paid 4 Customer Success teams ranging from 3 to 50 ICs, I’ll use an average fully-loaded headcount cost of $180k. Therefore, these 5-9 person teams are spending about $1m-1.5m per year. This does not include travel and software expenses which can add ~5-10%.

Based on SaaS Capital’s 2022 Spending Benchmarks for Private B2B SaaS Companies, venture-backed companies are spending 10% of their revenue on Customer Success. imho, this seems low.

If we wanted to use a more liberal, fully-loaded headcount assumption, $200k per head is not unreasonable—especially for enterprise, quota-carrying reps. The point is, Customer Success can get expensive quickly. So it’s pivotal to first align on why Customer Success exists in the first place.

Why does Customer Success exist?

This is a loaded question because it presumes Customer Success should exist.

As one of the fastest growing functions (Linkedin data) with increasing strategic priority (Custify; Forrester research), it is hard to argue otherwise. But make no mistake: it can be built badly for the wrong reasons.

If we assume Customer Success is 1) a significant investment intended to 2) deliver measurable business value, then perhaps the more interesting question is:

What would we need to know in order to build Customer Success most effectively?

From a first-principles perspective there are two big categories:

You and your software (key: humility)

Your customers (key: empathy)

To deeply understand these two categories takes work: create a culture of candor, obtain survey data, conduct interviews, pull usage data, do the research. Due to our human tendency toward availability, there will be a temptation to over-index on category 1. Resist it.

You and your software (key: humility)

Based on 10+ years of building Customer Success functions, I’ve found these 10 key “you” factors to be useful in crafting world-class CS teams.

Your customers (key: empathy)

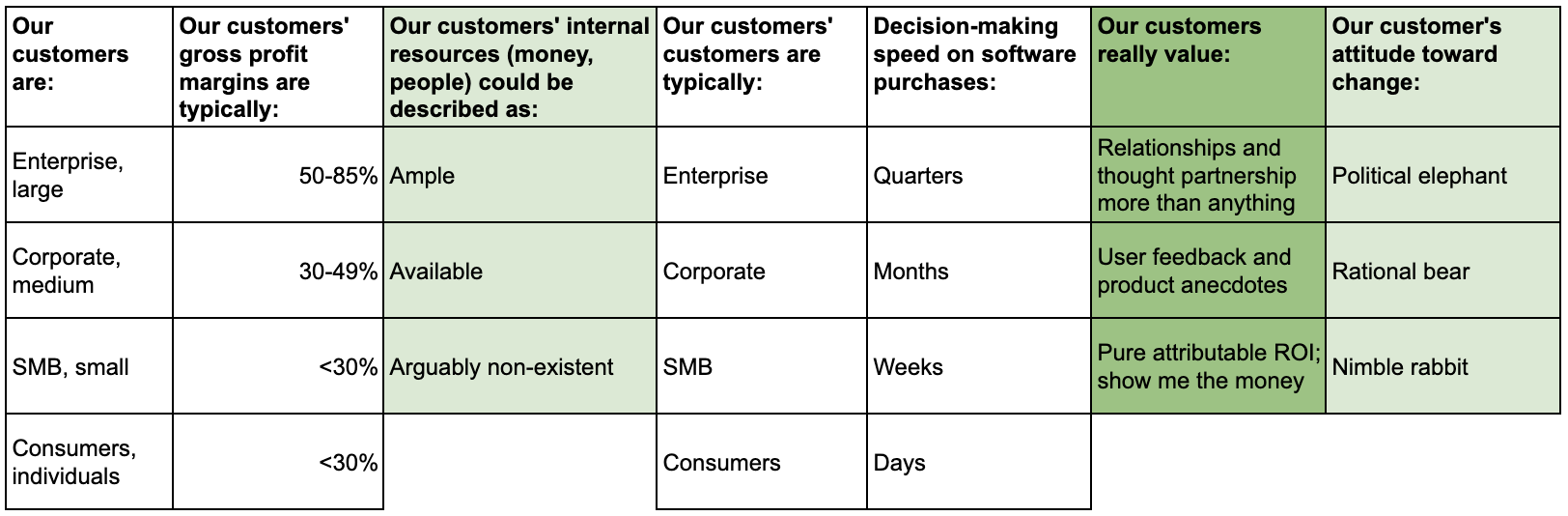

You never really stop learning about your customers. But as a starting point, here are 7 key “customer” factors that have been strategically valuable in building Customer Success.

But regardless of how you, your software, and your customers are graded in this framework, it is important to acknowledge that Customers Success—the function—is not a panacea for all problems. Many software companies have deployed Customer Success resources for the wrong reasons, e.g. band-aid for endemic product problems.

You and your software - likelihood of CS impact

There are some challenges Customer Success is very well-suited to solve. For this we look to the columns highlighted in light green (50% likelihood CS can impact) and dark green (80% likelihood CS can impact). Let’s run through them:

Ease of use: through product marketing, sharing best practices, and user trainings, Customer Success is well-positioned to improve the perceived ease-of-use of your software.

For example, a Customer Success Manager (CSM) at LinkedIn can deliver effective and engaging Sales Navigator user trainings to steer dozens—if not hundreds—of customer reps toward easy, repeatable workflows to increase their comfort with your software. They can also recommend configurations and integrations that would increase ease-of-use for end users, e.g. integrating Linkedin with Microsoft Dynamic 365 or Salesforce to reduce user burden.

Must have vs. nice to have: CS is well-positioned to increase the # of deployed use cases of your software—assuming they exist. They can also weld your softwares outputs—be it insights, data, decisions, feedback, analytics, reporting, et al—to your customers’ inputs. I call this “workflow integration” for lack of a better term.

For example, your customers have lots of meetings (just like you!). A good CSM can ensure key insights & reporting from your software is a valuable cornerstone of your customer’s Product or GTM leadership meeting.

Relevant data integration: CS is well-positioned, ideally during onboarding, to maximize the integration depth of your software. This increases the stickiness of your software.

For example, your customers have lots of interesting data sets. A good Technical Account Manager (and Sales Engineer) will create and maintain a watertight customer data discovery documents, and execute against all potentially valuable data integrations/pipelines. This tees up the CSM to project manage the customer toward greater product value.

Time to get fully live with product: an effective CS team can drastically reduce the time to first value. This often comes down to your 1) people: bandwidth and skill sets, 2) process: clarity around onboarding steps and exit criteria, and 3) technology: what they use to track simultaneous, potentially-complex onboardings.

For example, I’ve seen a superstar Launch Manager shave 4-5 weeks off an onboarding vs. her peers on comparable implementations.

Your customers - likelihood of CS impact

Similarly, when it comes to your customers, there are three areas were CS is particularly well-suited to drive outcomes:

Customers’ internal resources: CS is great at calling out resource gaps, building a business case, and making recommendations to executive sponsors.

For example, IT teams are notoriously under-resourced. A good CSM can fight to prioritize your software project vs. competing initiatives.

What customers really value: imho, this is where CS really shines bright green. Your CS team should have the superpower of creatively crafting and showcasing value based on what matters to the customer, e.g. top-to-top strategic partnership, thought leadership, user feedback, case studies, business impact/ROI.

For example, all customer want “ROI” but they often think about it differently. Many CSMs/AMs are experts at data-driven storytelling. They can deliver stories that capture hearts, and data that capture minds. They can also persuade executive sponsors to think of value in new and different ways.

Customer attitude toward change: whether your customer is a political elephant, rational bear, or nimble rabbit, effective CS teams can execute account plans to achieve outcomes. This is uniquely valuable when engaging large, enterprise accounts.

For example, a strong CSM/AM can identify and neutralize “detractors” within the account to preemptively remove roadblocks. They can accelerate product adoption by trumpeting your software’s success, and getting disparate stakeholders in the same room to green light a decision (and all the 1:1 side meetings that precede it). Super powerful, albeit hard.

Okay, lets do an example

To make this all more concrete, let’s apply the “You and Your Software” framework to the $50B software company, Stripe:

To be clear, this is my independent assessment. If the several Stripes in our readership correct me, I will be happy to update accordingly :)

As someone who has used their product and knows the company fairly well, I would consider them:

Large (~8,000 employees, $14B revenue) with a complex yet easy-to-use product/API offering.

Stripe sells to (nearly) every vertical with transparent, usage-based contracts typically owned by Engineering/Cost-to-Serve (sometimes Finance/Product).

Most customers would consider it a lifeblood “must have” which ingests all relevant data.

Stripe doesn’t have user heft of, say, a Slack, so I’ve estimated their user/employee % as <20% (mostly some Eng/Prod/Finance folks).

Fantastically, you can get live with most Stripe products in under a month.

Overall, a very strong company and offering. Using this inferred Stripe configuration, let’s explore the role of Customer Success at Stripe.

The role of Customer Success at Stripe

In a word: Growth.

Stripe has built an Account Management muscle across 3 segments based on net processing volume ($ flowing through Stripe) w/ varying AM portfolio sizes.

SMB: <$12m/year;

Growth: <$120m/year; 5-25 accounts each

Enterprise: >$120m/year; 1-5 accounts each

The CS/Account Management team, from my experience, is part of a 4-phase GTM lifecycle:

Sales: Solution Architect + Account Executive determine processing and scale viability with prospect.

Transition: Deployment & Integration engineers manage any customizations and shorten time to deploy.

Account Management: Account Manager + Technical Account Manager handle day-to-day issues, conduct business reviews, drive upsells and successful renewals.

Renewals: works closely with the AM for product-centric upsells, e.g. Stripe Custom Connect.

In summary, Customer Success at Stripe is a revenue-driving, account management function. Since Stripe’s software/APIs are so strong—easy-to-use, well-integrated, “must have”—they don’t need Customer Success heroics.

That’s not to say Stripe’s customers are without risk. In recent years, Stripe has had to defend their price (2.9% + 30¢ per successful card charge) against competition. Larger customers sometimes get a second payment processor—e.g. Chase Paymentech, First Data, Advantiv, Adyen in Europe—which opens to the door to a bake off/churn. But these risks are on the margin and not central to the “why” Customer Success exists at Stripe.

How to build Customer Success badly, in descending severity

“Invert, always Invert.” —Carl Gustav Jacob Jacobi

Hire a small CS army to jump on churn grenades that are, at their core, significant product gaps.

Bury the Customer Success function under a CRO who’s under immense sales pressure and has to make tradeoff decisions that favor new sales at the expense of existing customers, e.g. finite implementation resources.

Create a product feedback table in Notion that Customer Success populates without designating ownership and accountability to Product and Engineering leaders.

Isolate the function without direct collaboration with sales, i.e. no close partnership with sales.

Create monetary incentives based on laggy, infrequent and/or opaque KPIs.

Anoint Customer Success to be “trusted advisors” and then give them an upsell quota, i.e. wolves in sheep clothing.

Don’t define exit criteria for a successful onboarding. Leave the loose ends for someone else.

Confine Support to break/fix troubleshooting without giving them a channel to surface high-impact bugs. Remember, every ticket is a bug/opportunity.

Have CSMs own upsells for a long, complex sales cycle for upsell and/or expansion products.

Dispatch a team to “do trainings” without setting clear expectations for the outcomes/KPIs of trainings delivered.

What about Professional Services?

Charging for Customer Success—by virtue of Add-On Support, reserving CS only for higher tiers, and/or creating a full-fledged Professional Services team—is a nuanced topic.

The data suggests that as company gets larger and their softwares mature, the scope of Customer Success becomes encroached upon. It gets harder and harder to defend CS budgets for teams that don’t own a revenue number.

Using Salesforce as an example:

Salesforce spent $615m on Professional Services last quarter, or 8% of its subscription revenue ($7.6b).

The Professional Services team delivers: “process mapping, project management and implementation services and training services.” (source: Salesforce 10-Q, section: Revenue Recognition, p. 10)

Salesforce received $605m in Professional Services revenue last quarter, so the function operated at a modest loss of $10m.

Source: Salesforce 10-Q, quarter ending April 2023.

The Salesforce 10-Q regulatory filing from the quarter ended in April 2023 also states:

The cost of professional services and other revenues consists primarily of employee-related costs associated with these services, including stock-based compensation expense, the cost of subcontractors, certain third-party fees and allocated overhead. We believe that our professional services organization facilitates the adoption of our service offerings, helps us to secure larger subscription revenue contracts and supports our customers’ success. The cost of professional services may exceed revenues from professional services in future fiscal periods.

Notice the italicized portion from the Salesforce 10-Q above?

The cost of professional services may exceed revenues from professional services in future fiscal periods.

This means that Salesforce is willing to run ProServ at breakeven which isn’t uncommon for large software companies. Case in point, the cost of Professional Services ($615m) exceeded the revenue earned from it ($605m), so the unit operated at a 1.6% loss.